The promise of new flavours beckons from Banawe.

What Is the Best High Interest Savings Account in the Philippines?

It is safe to say that everyone must be saving money for something, especially since inflation is making its presence stronger every day. So if there is ever a time to look into a high-interest savings account in the Philippines, it’s right now. Here are some of the best options available so we can start saving.

Also read: What is Pag-IBIG MP2 Savings Program & Should I Invest in It?

Best high-interest savings accounts in the Philippines without initial deposits

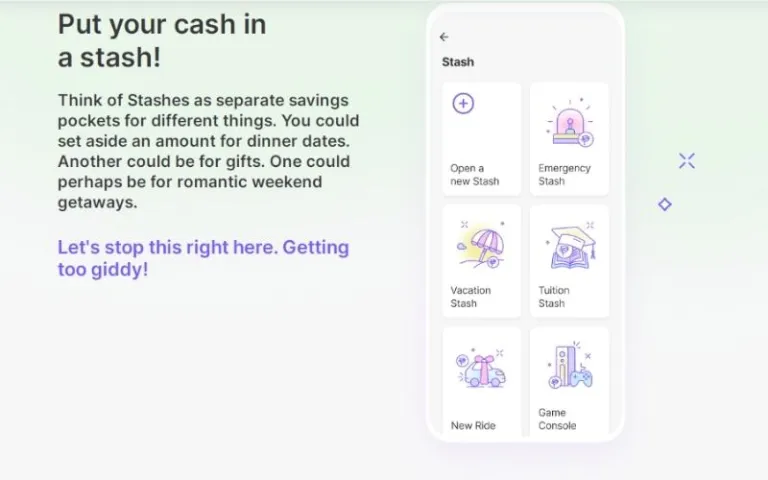

1. Tonik Bank Stash

Tonik is Southeast Asia’s first digital-only bank which made its way to the Philippines in 2021. It offers impressive convenience for users when it comes to accessing financial services — from opening accounts to transferring funds. Since they’re a digital-only bank, they have no maintenance costs, unlike physical banks. While this makes their services a bit limited, they make up for it by offering better interest rates and lower fees to customers.

Tonik savings accounts, known as Stashes, cost nothing to open. Aside from that, there is no interest-earning and maintaining balance to keep in check. You can actually open an account without money! How cool is that? Once you open an account with them, they can give you five Stashes, which means you can specify your savings for different goals. These stashes accrue a whopping 4% annual interest rate. Not bad at all!

If you are raising money with family or friends, you can also apply for a Group Stash, which has an annual interest rate of 4.5%. As long as you can maintain it, Tonik Stashes look like the best high-interest savings account in the Philippines, particularly if you have multiple saving goals.

Also read: 13 Mobile Banking Apps Every Pinoy Should Have

2. App

Everyone loves fuss-free financing, especially when it comes to saving. , a great savings app, lets you open an account without the worries of initial deposits and maintaining balances. In a few seconds, you can start an account and immediately transact through convenience stores and Bayad Centers.

Their annual interest rates are pretty good for a risk-free savings account. You can earn up to 3.25% once you save with the App. Their deposit limits are at ₱48,000, with interest rates starting at ₱50,000.

Worried where your deposits are made? You don’t have to! is powered by RCBC, and accounts opened through the app are essentially Basic Deposit Accounts (BDA) from the banking powerhouse.

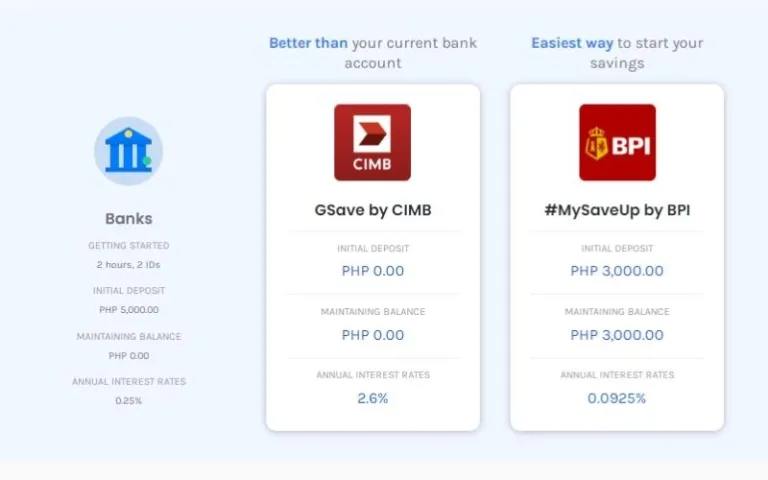

3. GSave

GCash has become quite popular, especially during the pandemic. A lot of people saved their money through the digital wallet, but what could they do with it? Fortunately, a partnership between GCash and CIMB produced GSave for people.

Their interest rates are certainly, ahem, interesting. You can earn up to 2.6% for annual interest rates, which will be paid out monthly. Saving a lot of money through GSave also has a very helpful advantage. Maintain a ₱5,000 balance in your GSave and CIMB will provide you free life insurance with coverage of up to ₱250,000. Terms and conditions apply, of course, but that’s free life insurance on top of your savings! What’s not to love?

Transactions between GCash and GSave are free, so you can make your finances flexible.

Also read: LIST: Bank Transfer Fees + Online Banks With NO Bank Charges!

4. Komo

Another high-interest savings account in the Philippines for people who can’t make initial deposits, Komo is a good digital option. Powered by EastWest Bank, it also forgoes the maintaining balance to accrue interest, incentivising bigger savings amounts instead. Interest-maintaining balance starts at ₱500,000 and will get you to 2.5% for the first tier. The next tier will get you 1.5% interest at ₱1.5 million. Finally, as its last tier, you get 1% interest for balances above ₱2 million

5. Sterling Bank Bayani OFW Savings

This option is best for OFWs who regularly remit to their families in the Philippines. Sterling Bank Bayani OFW Savings can conveniently credit funds going through iRemit centres in their country of employment. Interest rates start at 1% for just an interest-earning balance of ₱2,000. While there is no maintaining balance needed, OFWs must remit within 12 months to keep the savings account active.

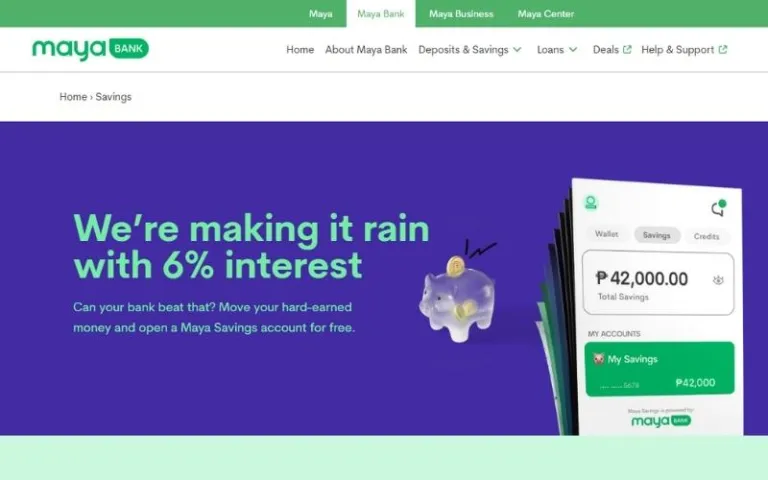

6. Maya Savings

Since shedding its PayMaya skin, Maya introduced itself back in the digital wallet game firing on all cylinders. They’ve added a few new features, such as Credit and Crypto, all in one place; they’ve also added a bunch of promotions to get you started. But, we’re here to talk about a particular feature: savings!

Their promotional interest rate is pretty high; it’s almost unbelievable. If you open a savings account through Maya, you can earn a 6% interest rate right then and there! The interest accrued will then be deposited into your Maya savings account. But you have to be quick, this introductory interest rate will only be up until 31 Aug 2022. If you reach a ₱15,000 balance, they can give you a Maya card as well before the promo date is up.

Best high-interest savings accounts in the Philippines with initial deposits

7. Citibank Peso Bonus Saver

If you happen to have ₱50,000 and don’t know what to do with it, I wish I were you. But I digress. Here’s a suggestion: You can open a Citibank Peso Bonus Saver and watch it grow. By increasing your maintaining balance for at least ₱5,000 for 12 consecutive months, you can accumulate interest rates of up to 1.56%. It may seem like a tall ask for a savings account, but the interest rate growth is almost like an investment at this point. Withdrawals and deposits from this account are free so there’s no pressure if you need to use these funds.

If you can afford to open a Citibank Peso High Rate Saver Account, I also wish I were you. For a measly sum of ₱100,000, you can enjoy a 0.70% interest rate from your initial deposit up until you reach ₱1M. You can then earn a 0.75% interest rate at ₱2 million and finally, up to 0.85% interest for a balance of at least ₱5 million. Now that’s a savings goal!

Also read: Mobile Banking Hacks: 6 Ways You Can Avoid Bank Transfer Fees

8. PNB Top Saver

Traditional banks still have decent options for savings accounts. One of the best high-interest savings accounts you can apply for without too much pressure is the PNB Top Saver. Initial deposits start at ₱30,000 with an annual interest rate of 0.125%. This can increase by up to 0.50% as long as your savings grow.

Opening a PNB Top Saver account, you have the option to choose a passbook or a PNB-PAL Mabuhay Miles debit card. If you enjoy travelling and are saving for that big overseas vacation, you’ll get more out of the PNB-PAL Mabuhay Miles debit card because you can earn Mabuhay Miles points when booking flights. You can also earn 500 Mabuhay Miles points within the first three months of issuance of your card when you book a flight from Philippine Airlines.

Also read: 10 Best Credit Cards for Travel in the Philippines

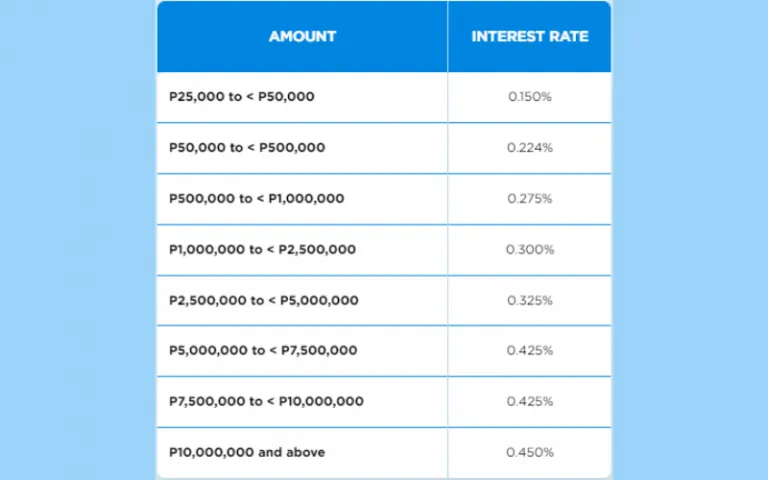

9. RCBC Dragon Peso Savings

This option has no frills, but the yield is pretty substantial. You will need at least ₱25,000 to open and maintain an RCBC Dragon Peso Savings account. But by increasing your savings, you can earn up to 0.5625% for annual interest rates. They’ll also give you a MyDebit ATM card for easier financial management, whether it’s for transactions or online shopping. It is powered by Mastercard, which can be used almost anywhere in the world (which can be a good or a bad thing, depending on your shopping habits).

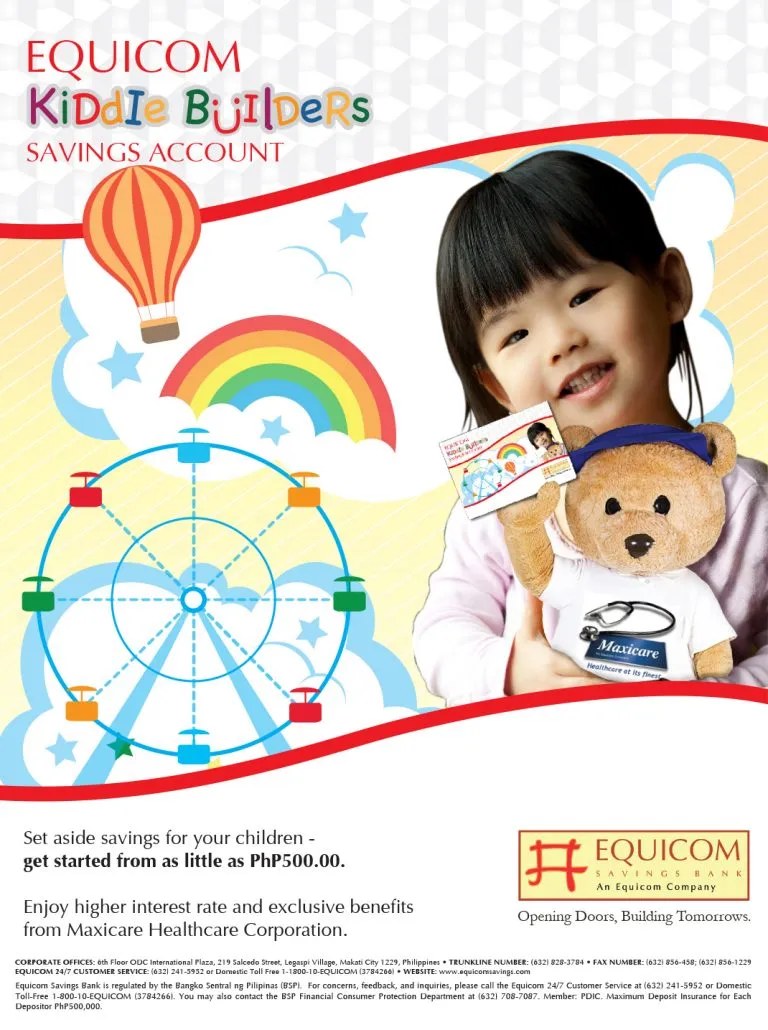

10. Equicom Kiddie Builders

Now, this is something that I could’ve used back in elementary school. For a mere ₱500, kids can open their own Equicom Kiddie Builders savings account. Keep in mind that the maintaining balance is at ₱500 and the interest-earning balance is at ₱1,000. Anyway, this savings account has a pretty high-interest rate for kids lower than 13 years old, starting at 0.50% per annum.

On top of the low requirements, Maxicare will also provide free insurance that covers medical and dental benefits for accounts with a balance of at least ₱15,000. Now, they can spend their own money buying Robux or diamonds for their mobile games!

Also read: 22 Money Saving Tips to Help Build Your Savings in 2022

Saving can be difficult, especially since our economy has been volatile for the worst. So, it always pays off to learn about what a high-interest savings account in the Philippines could do for you. Should these price increases settle down, maybe we can save for better things in the near future. Now, if we could only earn more…

Featured image credited to prathan chorruangsak via Canva Pro.

Published at

About Author

Aldous Vince Cabildo

Subscribe our Newsletter

Get our weekly tips and travel news!

Recommended Articles

10 Best Banawe Restaurants for a Mouthwatering Food Trip in QC 14 Best Credit Cards for Travel in the Philippines The only plastic we need for travel.

10 Commandments for Responsible Travel Flexing Spread the good word!

10 Long Weekends in the Philippines in 2023 Book those flights ASAP.

10 Tips for Planning Out-of-Town Trips During Typhoon Season Stay safe and travel well during the rainy season.

Latest Articles

Luisa Yu: 80-Year-Old Filipina Travelled 193 Countries in the World Travel has no limits, and neither does Luisa Yu at 80!

Cebu Pacific’s First Clark to Coron Flight Takes Off! Direct flights to Coron now boarding!

7 Best Pet-Friendly Beach Resorts in Batangas and Zambales Why leave your pet behind when these pet-friendly beach resorts in Batangas and Zambales offer the perfect getaway?

Calbayog Zipline: One of the Longest Overwater Rides in the Philippines Glide over the ocean on one of the longest overwater ziplines in the Philippines

Complete Thrilling Travel Guide to Cambugahay Falls in Siquijor Swing, swim, and soak in the beauty of Cambugahay Falls Siquijor!