The promise of new flavours beckons from Banawe.

What is Pag-IBIG MP2 Savings Program & Should I Invest in It?

If you’re looking for an investment opportunity that is affordable and almost risk-free, Pag-IBIG MP2 savings might just catch your interest. This offer from the government corporation differs from the usual salary deductions of the everyday employee. What makes it different, you ask? We cover all your questions about the Pag-IBIG MP2 savings in this article, so keep reading.

Also read: 7 Valid IDs in the Philippines You Should Have Right Now as an Adult

Note: It can be difficult to commit to an investment in the middle of economic strife. With reports of job entrenchments during the pandemic and market prices inflating at an alarming pace, maybe an investment is the last thing on your mind. The entire world is financially recovering, after all, so don’t get too pressured if you can’t start investing yet.

On that note, once you’re ready to take a step towards your financial goals, Pag-IBIG MP2 savings is a good addition to the portfolio, whether you want to start small or you’re looking for more options.

What is ?

The Modified Pag-IBIG Savings (MP2) is a separate savings platform for current and former Pag-IBIG members who wish to earn more by investing. It has a five-year maturity for Pag-IBIG members, with dividends derived from 70% of the corporation’s annual net income. And since contributions are voluntary, dividends are made higher than the regular savings platform.

Pag-IBIG MP2 savings features

The great thing about MP2 savings is that you can start saving and investing for as low as ₱500 per remittance. While ₱500 is the minimum, there is no limit on how much you want to save. You can also open and maintain multiple savings accounts if you want to diversify your investments.

The dividends that you will earn as your Pag-IBIG MP2 savings account grows are tax-free. While maturity for your savings spans five years, you can also choose to withdraw these dividends annually. All of these withdrawals are also government-guaranteed, making them perfectly safe.

Also read: 22 Money Saving Tips to Help Build Your Savings in 2022

How much could you earn from Pag-IBIG MP2 savings?

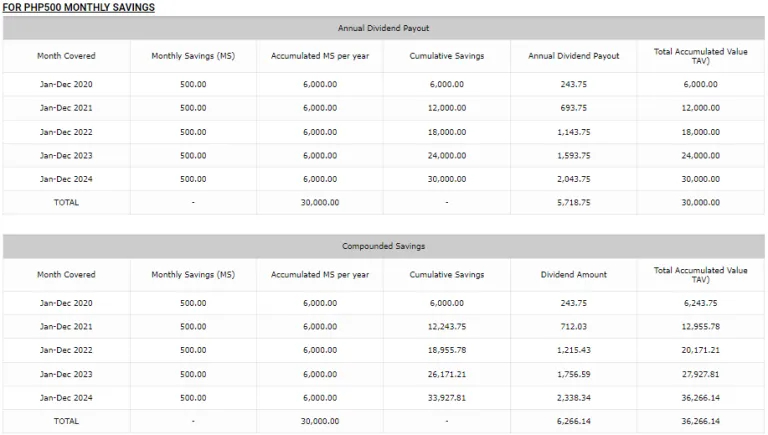

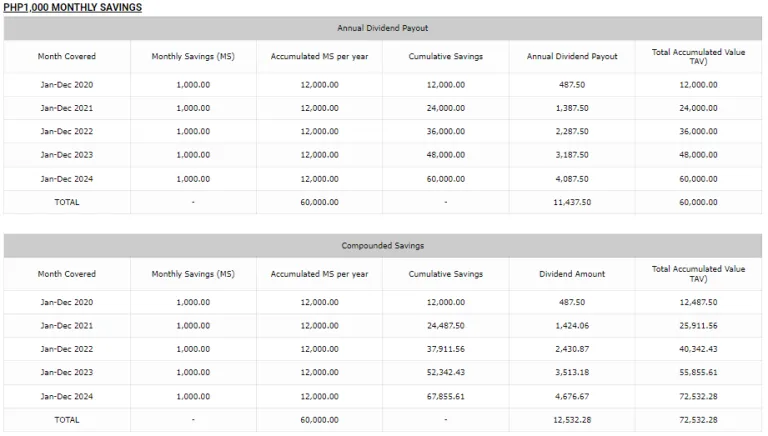

Since contributions are voluntary and there are no limits to how much you can remit when saving, dividend rates for Pag-IBIG MP2 savings are naturally higher than the standard platform. It also gives you much more earning potential by remitting higher amounts to your account.

Here are examples based on remitting monthly amounts of ₱500 and ₱1000 based on a 7.5% dividend rate from Pag-IBIG:

Enrolling for the Pag-IBIG MP2 savings program

Enrolling for MP2 savings is easy! Just fill in your details on the MP2 Savings Enrollment page. You can also do this in any Pag-IBIG branch when you submit an accomplished application form. Download the form here.

Remitting money to your account

Active Pag-IBIG members who wish to have their remittance for the Pag-IBIG MP2 savings deducted from their salaries may do so by arranging the process with their employers. Alternatively, technology has made it possible to pay with digital wallets. You can remit through these payment channels:

- GCash

- Coins.ph

- 7-Eleven

- Bayad Center

- M.Lhuillier

Receiving and withdrawing your earnings

You can withdraw your savings dividends in one of two ways. First, after the five-year maturity period comes to fruition, you will receive the compounded amount from your Pag-IBIG MP2 savings upon withdrawal.

For annual payouts, you can visit Pag-IBIG Fund accredited banks and withdraw the savings dividends credited to your savings or checking account. Filipinos who have opened an account for the platform with foreign banks will be issued checks for their savings dividends instead.

Also read: Here’s Why We Should Shift to Cashless Payments Instead

It should be noted that MP2 accounts can be pre-terminated before maturation. They can still receive their savings dividends from the platform, but it should be under the terms and conditions of Pag-IBIG. So, make sure that when you pre-terminate your account, it still falls under the rules to earn at least 50% of the savings dividends!

While Pag-IBIG MP2 savings provides higher earnings and more effective savings, it can still be quite a big step for some, especially in this economy. It is a good thing that MP2 can be scaled to amounts that you can be comfortable with. With options like these, these choices are a bit easier to make.

Featured image credited to johan10 via Canva Pro.

Published at

About Author

Aldous Vince Cabildo

Subscribe our Newsletter

Get our weekly tips and travel news!

Recommended Articles

10 Best Banawe Restaurants for a Mouthwatering Food Trip in QC 14 Best Credit Cards for Travel in the Philippines The only plastic we need for travel.

10 Commandments for Responsible Travel Flexing Spread the good word!

Top 10 Post-Breakup Destinations for Healing and Self-Rediscovery Ready for a solo travel?

10 Tips for Planning Out-of-Town Trips During Typhoon Season Stay safe and travel well during the rainy season.

Latest Articles

Halal Town Manila: Quiapo Set to Become a Muslim-Friendly Food and Culture Hub Manila is about to get more muslim-friendly!

Italian Cuisine Earns UNESCO Status as Intangible Cultural Heritage Food with culture

MMDA Urges Malls to Limit Sales as Marcos Highway Traffic Worsens Commuters are frustrated, but is this really the solution to heavy traffic?

How Filipino Travellers Can Save on Noche Buena and Spend More on Travel Holiday savings for travel

Thailand Eyes to Build Disneyland Instead of Casino Complex Thailand is considering bringing Disneyland to the country, replacing a previously proposed casino and entertainment complex.