The promise of new flavours beckons from Banawe.

A Freelancer’s Adulting Guide to SSS, PhilHealth, & Pag-Ibig

So, you’ve decided to become a freelancer! While being your own boss offers flexibility and independence, it also comes with the responsibility of managing your monthly contributions and benefits on your own. For many Filipino freelancers, Social Security System (SSS), Philippine Health Insurance (PhilHealth), and Home Development Mutual Fund (Pag-IBIG) are the most crucial government-mandated contributions.

We know managing these monthly freelance contributions can be tedious. To make it easier for you, we’re walking you through how to navigate these in our freelancer’s adulting guide!

Also read: An Adulting Guide: Freelance or Employment — Which One’s For You?

What are SSS, PhilHealth, and Pag-IBIG contributions?

According to the Philippine labour laws, all workers are required to be members of SSS, PhilHealth, and Pag-IBIG programmes. Before we get into the nitty-gritty details, let’s take a look at the purpose and benefits of each.

1. SSS

Social Security System or SSS is a social insurance program mandated by the government to all income-earners or workers that provides social security benefits. These include retirement pensions, maternity, disability, death, and sickness benefits. Eligible members also have the opportunity to avail of loans for salary, housing, business, and education.

As a self-employed worker or freelancer, you can contribute a portion of your income and are eligible for these benefits upon reaching retirement age or in case of emergencies.

For more information about SSS and its benefits, click here.

2. PhilHealth

Philippine Health Insurance or PhilHealth provides Filipino workers with universal health insurance coverage and healthcare services. That said, PhilHealth members are entitled to financial aid covering medications, hospital expenses, and certain inpatient and outpatient procedures.

For more information about PhilHealth and its benefits, click here.

3. Pag-IBIG

Home Development Mutual Fund or Pag-IBIG provides Filipino workers with housing and savings assistance programmes. Eligible members can avail of housing loans, multi-purpose loans as well as calamity loans. In addition to its standard savings program, members can also participate in the Pag-IBIG MP2 Savings. This special savings facility allows you to save more and earn higher dividends.

For more information about Pag-IBIG and its benefits, click here.

Also read: 7 Valid IDs in the Philippines You Should Have Right Now as an Adult

Monthly contribution rates for SSS, PhilHealth, and Pag-IBIG

Before we guide you through the process of settling your monthly payments, see the contribution rates below to find out the amount that aligns with your income:

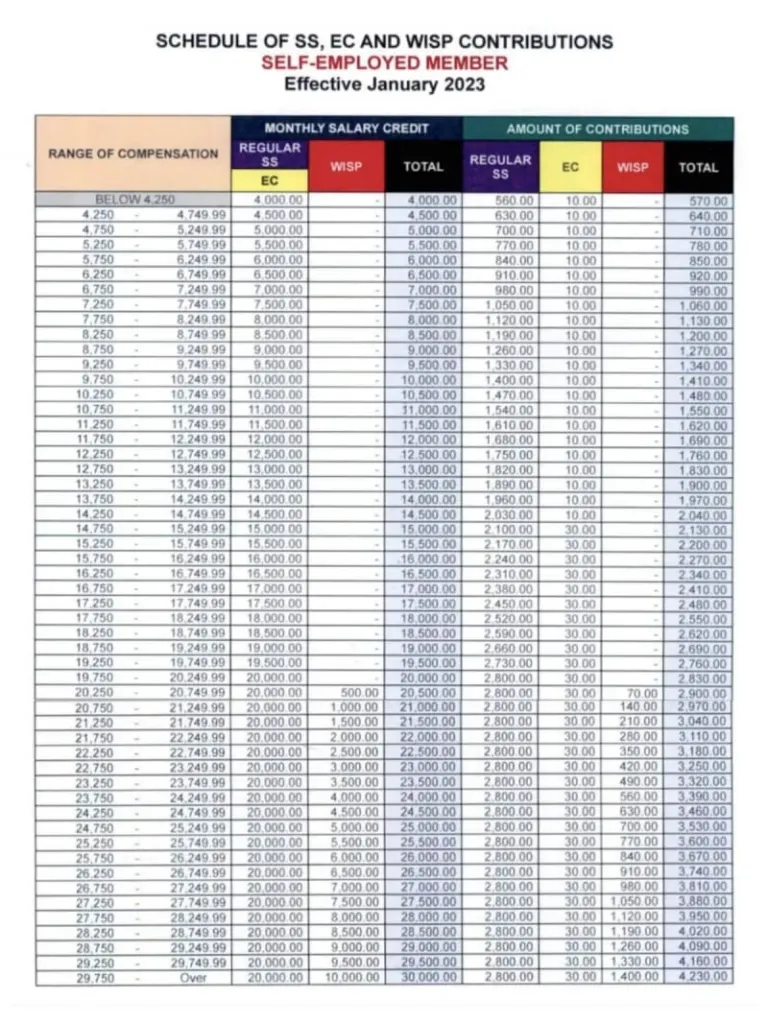

1. SSS contribution table for self-employed members

Effective 2023, the SSS contribution rate has risen to 14% from the previous 13%. This rate will see a gradual 1% increase every other year until 2025. As of 2024, the SSS monthly contribution rate remains fixed at 14%.

2. PhilHealth contribution table for self-employed members

As of 2024, the PhilHealth contribution for self-employed members has increased to 5% from the previous 4%. Additionally, the income ceiling is now at ₱100,000.

| Monthly Income | 2024 PhilHealth Contribution | PhilHealth Monthly Contribution |

| ₱10,000 (min) | 5% | ₱500 |

| ₱100,000 (max) | 5% | ₱5,000 |

3. Pag-IBIG contribution rates for self-employed members

As of 2024, the updated mandatory monthly contribution for Pag-IBIG is set at ₱200 for the employee’s portion and ₱200 for the employer’s share. Thus, freelancers must contribute ₱200 per month, covering both the employee’s and employer’s share. Moreover, there’s an option to make contributions exceeding ₱400, especially if you intend to apply for a loan or if you wish to save more.

SSS, PhilHealth, and Pag-IBIG payment processes

Now that you know how much you should be paying for your SSS, PhilHealth, and Pag-IBIG contributions, here’s how you can settle your payments:

Note: This online payment guide is for existing members of SSS, PhilHealth, and Pag-IBIG. Moreover, if you were previously employed, you must change your membership type before settling your payments.

How to pay SSS contributions online

- Log in to your SSS online portal. If you don’t have an MY.SSS Member account yet, you can register here.

- Generate a Payment Reference Number (PRN). Provide the necessary information needed to complete your request: Membership type, applicable period, contribution, and WISP plus amount (if applicable).

- Take note of your PNR and the final amount due since you will have to provide this when paying online.

- Proceed to online payment through either of the following: GCash, UnionBank, BancNet, or Billeroo.

How to pay PhilHealth contributions online

- Log in to your online PhilHealth Member Portal. If you don’t have an account yet, you can register here.

- Generate a Statement of Premium Account (SPA).

- Confirm your request by clicking “YES”.

- You will be redirected to a page where you can choose your online payment method: GCash, Maya, credit card, or debit card.

How to pay Pag-IBIG contributions online

- Log in to your Virtual Pag-IBIG Member Portal. If you don’t have an account yet, you can register here.

- Click “Regular Savings” and provide the necessary information needed.

- Provide your billing address and contact information.

- Review your payment summary before confirming your request.

- You will be redirected to a page where you can choose your online payment method: GCash, Maya, credit card, or debit card.

Also read: 12 #Adulting Apps Every Pinoy Millennial Should Have

There you have it! We hope this guide to SSS, PhilHealth, and Pag-IBIG helps you better navigate your monthly contributions as a freelancer. Thinking about working freelance? Find out if it’s the right fit for you here!

Featured image credit: pondsaksitphotos via Canva Pro

Published at

About Author

Andrea Larice Yap

Subscribe our Newsletter

Get our weekly tips and travel news!

Recommended Articles

10 Best Banawe Restaurants for a Mouthwatering Food Trip in QC 14 Best Credit Cards for Travel in the Philippines The only plastic we need for travel.

10 Commandments for Responsible Travel Flexing Spread the good word!

10 Long Weekends in the Philippines in 2023 Book those flights ASAP.

10 Tips for Planning Out-of-Town Trips During Typhoon Season Stay safe and travel well during the rainy season.

Latest Articles

Mango Ranch Waterpark: Negros Oriental’s Hottest New Attraction Make a splash at Negros Oriental’s newest adventure hotspot!

Nagsasa Cove Zambales Travel Guide: Hidden Beach Escape A serene cove for campers and chill seekers

A Must-Visit Food Destination in Japan: Restaurant of Mistaken Orders A must-visit where mistakes make meals memorable!

Best Travel Gifts for Travellers: Practical and Thoughtful Ideas for 2025 Top Travel Gift Ideas for 2025

Your Ultimate Guide to Must-Visit Summer Destinations in the Philippines Perfect for adventure seekers and beach lovers!