The only plastic we need for travel.

Tonik Digital Bank Launches as the First Neobank in the Philippines

In case you haven’t heard: Tonik Digital Bank, the first neobank in the Philippines, has officially launched in March 2021. As a neobank, it exclusively operates digitally, without physical branches whatsoever. This means that Tonik has lower operational costs; hence, it offers lower customer fees and higher interest rates — up to 6% per annum.

Also read: LIST: Bank Transfer Fees + Online Banks With NO Bank Charges!

Tonik Digital Bank: Services and features

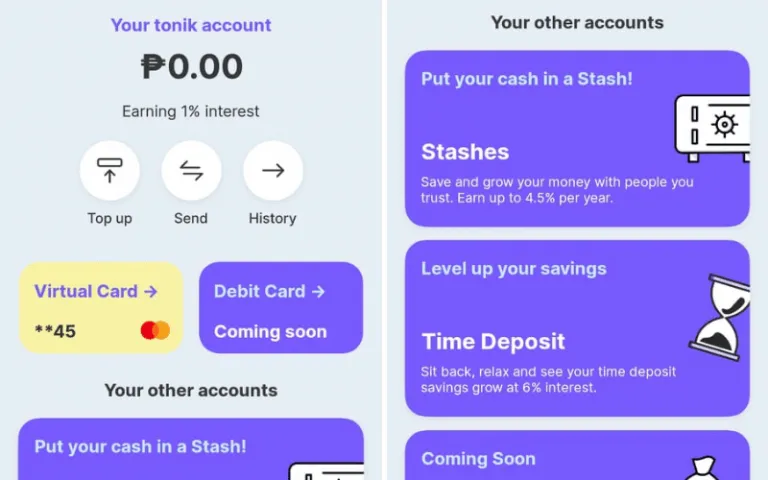

Basically, Tonik operates just like the traditional bank, only it relies solely on technology. It allows deposits, withdrawals, loans, payment, and even card products. Aside from the main account (1% interest p.a.), Tonik offers its users up to five stashes and five time deposit accounts.

What are stashes?

Stashes are simply digital wallets inside your account which allow you to organise your savings by goals. Tonik offers Solo Stashing (with 4% interest p.a.) and Group Stashing (up to 4.5% interest p.a.).

With Solo Stashing, you can save up for personal goals — like an emergency fund, a travel fund, or a car fund. Meanwhile, Group Stashing allows you to save with your friends and family for a common goal. (Can you imagine the potential for your future trips? Saving up for a barkada travel fund with 4.5% interest p.a. sounds exciting, to say the least!)

Also read: 8 Mobile Banking Apps Every Pinoy Should Have

How does the Tonik time deposit work?

Tonik offers a time deposit rate of up to 6% p.a., depending on your chosen term. With no minimum amount, you can deposit your extra savings and see your money grow through time. Periods of maturity range from six months to two years.

How does the debit card work?

Every Tonik user is entitled to a free virtual debit card and a Mastercard (₱250) available by request. With the virtual debit card, you can shop online, pay bills, et cetera. But with the physical card, you can withdraw through any ATM with no fees (unless the ATM you withdraw from additional bank access fees).

Also read: Here’s Why We Should Shift Towards Cashless Payments

How safe is the Digital Bank?

While in its infancy, Tonik certainly has a lot to prove to its users. However, it’s worth noting that the bank is now regulated by the Bangko Sentral ng Pilipinas (BSP) and insured by the Philippine Deposit Insurance Corporation (PDIC) for up to ₱500,000 per user. Tonik is also accredited by CredoLab, one of Southeast Asia’s leading alternative credit scoring companies.

How do you open an account?

Using cutting-edge technology, Tonik Digital Bank makes opening an account extremely quick and convenient. As long as you have Internet connection and a valid ID card, you can create a Tonik account in under five minutes.

- Install the Tonik app via Google Play or iOS.

- Open the Tonik app and enter your mobile number.

- Read the terms and conditions. Click “Agree and Continue”.

- Select your nationality.

- Click “Initiate Face Identity Scan”.

- Take a selfie.

- Scan your valid ID.

- Sign on screen.

- Review the details of your account.

- Head to the Tonik dashboard.

- Click “Verify Your Email”.

- Enter the OTP sent to your email.

Believe it or not, that’s all it takes to create an account with Tonik Digital Bank! Are you ready to try it out yet? For more information, visit their official website.

Published at

About Author

Danielle Uy

Subscribe our Newsletter

Get our weekly tips and travel news!

Recommended Articles

14 Best Credit Cards for Travel in the Philippines 11.11 Seat Sales to Fly to Your Revenge Travel Destination The savings are beyond comparison!

The 2021 Global Korea Scholarship Is Accepting Applications This March Don’t miss this chance!

2021 Planners: Our Top Picks & Where to Buy Them 2021, come faster!

This 2022 Japan Postgraduate Scholarship Grant Is Now Open for Pinoys You can finally study in Japan for free!

Latest Articles

Best time to Visit Taiwan Based on Weather Seasonal travel guide to Taiwan

Viral 7-Eleven with Mayon Volcano View Now a Major Photo Spot in Bicol This 7-Eleven in Albay with the Mayon Volcano view is being hailed as the Philippines' version of Lawson and Mt. Fuji!

Complete Surigao City Travel Guide: Everything You Need to Know on Your First Visit Island life, mangroves, sunsets—Surigao’s got it all!

Papal Transition 2025: Reliable Tips For Filipino Travellers in Rome Witness history unfold in Rome during the 2025 papal transition.

Best Time To Visit Vietnam: A Month-by-Month Guide Plan the perfect trip by season