The only plastic we need for travel.

Digital Banks in the Philippines That You Can Open Virtually

0Digital banks have taken the pandemic world by storm. Even in the Philippines, where many perceive online banking as high-risk, digital banks have seen a surge in enrollments, especially since the early days of the pandemic.

Indeed, the future of digital banks in the Philippines looks brighter than ever. Online banking has finally proved to be essential and convenient, especially now that cashless payments have become more widespread in the country. If you’re looking to open an account for yourself, then read on to learn about the available digital banks in the Philippines.

Also read: Bank Transfer Fees + Online Banks With NO Bank Charges!

Branchless digital banks in the Philippines

Presently, there are a handful of digital-only banks in the Philippines. Since these banks don’t have any physical branches, they typically have minimal operating costs. With this, they can afford to offer higher interest rates than traditional banks.

CIMB Bank PH

A couple of years after CIMB’s launch in the country, the bank has already gained millions of enrollments. By partnering with GCash, the bank has provided one of the easiest ways to open a digital bank account in the Philippines.

Its convenience of use aside, CIMB also provides interest rates that are higher than that of traditional banks. No wonder so many Pinoys have turned to this bank to grow their savings!

Minimum initial deposit: None

Savings interest rate (p.a.): 0.50-2.60%

Maintaining balance to earn interest: None

GoTyme Bank

One of the latest digital banks in the Philippines, GoTyme Bank launched in late 2022 through the collaboration of the Gokongwei Group and Singapore-based Tyme Group. It adapts a “phygital” model, offering both digital transactions and physical kiosks nationwide. The digital bank also provides an instant VISA debit card for free, as well as three free interbank transfers per week.

Minimum initial deposit: None

Savings interest rate (p.a.): 3%

Maintaining balance to earn interest: None

Also read: Mobile Banking Hacks: 6 Ways You Can Avoid Bank Transfer Fees

SeaBank Philippines

Launched in June 2022, SeaBank Philippines operates under SeaMoney, a leading financial service provider in Southeast Asia. But you might better recognise the provider for its mobile wallet, ShopeePay. As subsidiaries of SeaMoney, SeaBank and Shopee allow seamless online payments and fund transfers between each other.

Despite being in its early days, SeaBank has already secured many Filipino users, widely thanks to its notably high-interest rate. But what makes the bank more interesting is its daily payout of interest earnings — something you won’t get from other online banks. Plus, you can easily open an account for free with just one valid ID.

Minimum initial deposit: None

Savings interest rate (p.a.): 6%

Maintaining balance to earn interest: None

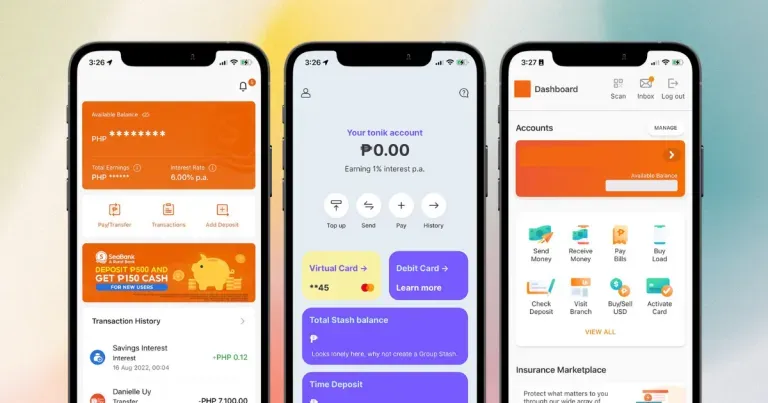

Tonik Digital Bank

A trailblazer in our local fintech industry, Tonik prides itself as the first neobank in Southeast Asia. Distinguishing itself from other known digital banks in the Philippines, such as ING and CIMB, Tonik has no affiliation with any physical banks anywhere in the world.

Being an exclusively digital bank, Tonik ensures minimal operating costs. Currently, it offers the highest interest rate for savings accounts in the country. Tonik also provides users with a Time Deposit product, where they can expect up to a 6% interest rate per annum.

Minimum initial deposit: None

Savings interest rate (p.a.): 1.00-4.50%

Maintaining balance to earn interest: None

Maya Bank

PayMaya is back and cooler than ever, now going by the name Maya Bank. Aside from donning a fresher look, Maya also provides more convenient features. The digital bank lets users create savings and credit accounts, pay bills, and access cryptocurrency, micro-investments, and insurance. It also offers physical debit cards.

Minimum initial deposit: None

Savings interest rate (p.a.): 6%

Maintaining balance to earn interest: None

Also read: 5 Smarter Ways to Build Your Emergency Fund

Digital banks in the Philippines with physical branches

While digital-only banks generally offer higher interest rates, they have their disadvantages. If you regularly do cash transactions, some neobanks might charge a fee for ATM withdrawals. Also, digital-only banks offer limited in-person support compared to traditional banks.

Thus, if you want to have a secure account under digital banks affiliated with traditional banks in the Philippines, here are your options.

DiskarTech by RCBC

Financial literacy should be as inclusive as possible. DiskarTech evidently recognises this, as it is the first digital bank in the Philippines to employ the Taglish language. On top of that, DiskarTech also has an impressive interest rate, which is even higher than the more popular digital banks in the Philippines! The bank also offers free and real-time money transfer services via InstaPay.

Minimum initial deposit: None

Savings interest rate (p.a.): 3.25%

Maintaining balance to earn interest: None

Also read: How to Loan on DiskarTech According to This Hilarious Commercial

UnionBank Online

UnionBank must be one of the most acclaimed traditional banks to transition to digital banking. It has won several awards since the launch of its app, including Best Digital Bank for three consecutive years.

UnionBank allows free and real-time money transfers via InstaPay. It also provides diverse savings account options for various needs: Avid online shoppers can apply for a Lazada Debit Card; travellers can opt for the GetGo Debit Card; gamers may enjoy the PlayEveryday Savings Accounts. However, if you’re simply looking for a no-frills savings account, Unionbank also offers Personal Savings, which has no maintaining balance.

UnionBank Personal Savings Account

Minimum initial deposit: None

Savings interest rate (p.a.): 0.10%

Maintaining balance to earn interest: ₱10,000

UnionBank Regular Savings Account

Minimum initial deposit: ₱10,000

Savings interest rate (p.a.): 0.10%

Maintaining balance to earn interest: ₱25,000

Also read: 8 Mobile Banking Apps Every Pinoy Should Have

Komo by EastWest

Proving that the Philippines is making strides towards a cashless society, EastWest opened Komo in 2020. As the first universal banking group in the country to launch its very own digital bank, Eastwest aims to let Filipinos gain control over their money; thus, naming their digital bank Komo, as in “Kontrol mo ang pera mo.”

In Jun 2021, Komo also launched an insurance product called Troo Flex. According to EastWest, this will be the first customisable insurance app in the Philippines. Basically, users can “add-to-cart” the products that they need. Its insurance products cost as low as ₱300 per year.

Minimum initial deposit: None

Savings interest rate (p.a.): 1.00-2.50%

Maintaining balance to earn interest: None

HelloMoney by AUB

Another pandemic-born digital bank, HelloMoney was launched in Apr 2020. To help Filipinos transition to online banking at the age of social distancing, the prepaid digital bank ensures a quick, fully online registration.

Unlike traditional banks that have operating hours, HelloMoney works as a mobile wallet with 24/7 services. Users may also cash in through AUB branches if transferring money online isn’t an option.

Minimum initial deposit: None

Savings interest rate (p.a.): 0%

Maintaining balance to earn interest: None

iSave by Maybank

Maybank unveiled its first digital bank, iSave, in Nov 2020. Anyone could open an account through the Maybank2U PH App.

The digital bank functions just like a regular savings account, minus the required initial deposit and maintaining balance. Aside from allowing online transactions, iSave also lets users deposit in any Maybank branches. On top of that, iSave users can withdraw from any Bancnet ATM in the Philippines for free. Free withdrawals also apply to any Maybank ATM in Malaysia, Singapore, Cambodia, and Brunei.

Minimum initial deposit: None

Savings interest rate (p.a.): 0.25%

Maintaining balance to earn interest: ₱20,000

OFBank by LANDBANK

Finally receiving its digital banking license from the BSP in Mar 2021, OFBank is now hailed as the first digital-only government bank in the Philippines. Created to support overseas Filipino workers, this bank specifically provides products and services tailored to the financial requirements of OFWs.

Like all digital banks, OFBank allows fully virtual registration. It lets users open deposit savings accounts, transfer funds, pay bills, and apply for multi-purpose loans online.

Minimum initial deposit: None

Savings interest rate (p.a.): 0.10%

Maintaining balance to earn interest: None

Also read: Crypto Investments for Dummies: The Basics of Cryptocurrency & Why It’s a Big Deal

With all these digital bank options in the Philippines, we hope you find the right one for you. If you’re just starting out on your journey towards financial freedom, check out our money-saving tips here.

Published at

About Author

Danielle Uy

Subscribe our Newsletter

Get our weekly tips and travel news!

Recommended Articles

14 Best Credit Cards for Travel in the Philippines 21AM Digital Museum by CCP Launches on 25 Feb 2022 View the inaugural exhibition for free!

Why You Have to Try Listening to 8D Music on YouTube It’s a mind-blowing experience.

12 #Adulting Apps Every Pinoy Millennial Should Have Confession: As I continue to progress further into my 20s, I undeniably find myself morphing into the tita I never thought I would be. And by this, I mean I’ve learned to (obsessively) monitor my expenses through various #adulting apps, realised we really do have food at home (because eating out has made a giant […]

10 Aesthetic Electric Fans That Scream #HomeGoals We scoured the Internet for the prettiest ones.

Latest Articles

Dingalan Travel Guide: Nature Spots to Discover Now Underrated coastal gem in Aurora

What to Eat in Bicol: Iconic Dishes and Treats, and Unique Pasalubong You’ll Love Spice up your foodie adventure with iconic Bicol dishes and must-try pasalubong!

Top Travel Trends in the Philippines for 2025 New spots, tips, and trends

New UK Adventure Park to Visit in Devon and Cornwall Fun countryside escape near London

Ultimate Camarines Norte Travel Guide: Waterfalls, Beaches, and More From surfing to secret waterfalls, Camarines Norte is your next escape!