The only plastic we need for travel.

How to Send Money to Palawan Express Through Online Banking

It’s undeniable that pandemic times have been harder on families that live in different parts of the Philippines. With so many safety-related matters to consider, even something as simple as sending financial support to their loved ones has become quite a challenge. Given that not everyone has shifted to mobile banking, a lot of Pinoys still rely on remittance centres like Palawan Express to send funds across the country.

This has led many of us to look for ways to skip having to go to remittance centres and send the necessary funds without having to leave our houses. If you’ve been searching for options on how to send money to Palawan Express through online banking, we’ve done the work for you. Just go through this list and find the alternative that works best for you!

Also read: Digital Banks in the Philippines That You Can Open Virtually

Important reminders

First time sending money to Palawan Express via online banking? Here are the most important things to know before doing so:

- Make sure the recipient has a valid ID to present. You can check Palawan Express’ list of accepted IDs here.

- Be very careful when filling up the recipient’s information — especially his or her name. There have been countless instances wherein recipients were unable to claim their money because the provided info didn’t match the name written on the ID. Even the most minor typographical error could prevent you from picking up your cash.

- Proceed to an official Palawan Express branch rather than an authorised agent.

How to send money to Palawan Express online

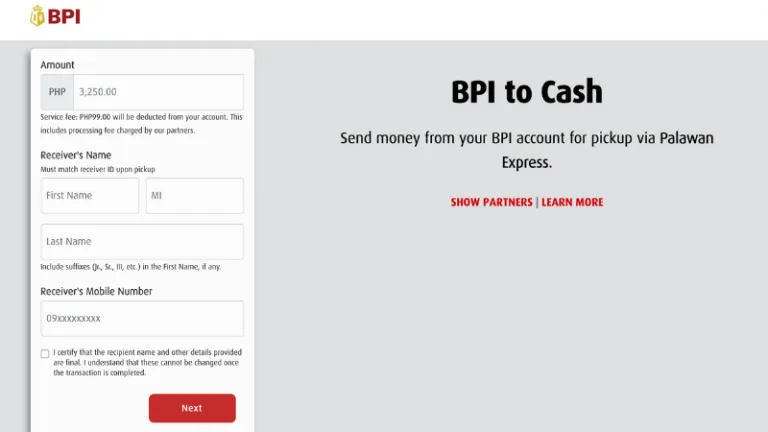

1. BPI to Cash

Service fee: ₱99

Limit: ₱10,000 per transaction

How soon are funds available for pickup? Around four hours; cut-off time for processing is 1.30pm.

How to send money to Palawan Express through BPI

- Go to the BPI Online website or launch the BPI app, then select “BPI to Cash.”

- Choose Palawan Express for cash pickup.

- Provide the following information:

- Amount to send

- Receiver’s name (first name, middle initial, last name)

- Receiver’s mobile number

- Confirm the details, read and check the certification box, and click “Next.”

- Enter your registered email address.

- Log in to your BPI Online Account.

- Select which source account you would like to use, then click “Pay.”

- Enter the One-Time PIN (OPT) sent to your registered number and click “Proceed.”

- Save the 13-digit BPI to Cash reference code that will appear on the screen, and send it to the receiver.

Steps for the recipient

- Save the 13-digit BPI to Cash reference code from the sender.

- Visit your nearest Palawan Express branch.

- Inform the teller you are claiming via BPI to Cash and fill out the necessary form.

- Present a valid ID and the 13-digit reference code.

- Claim your cash.

For more information, visit BPI Online’s official website.

2. Metrobank to Palawan Express

Service fee: ₱100

Limit: ₱10,000 per transaction

How soon are funds available for pickup? Cash can be remitted in real-time.

How to send funds to Palawan Express through Metrobank

- Launch the Metrobank app.

- Choose “Cash Pick-up.”

- Provide the recipient’s information:

- Name (first, middle, last)

- Address

- Mobile number

- Email address

- Nationality

- Purpose

- Select your desired source account. (Take note that only savings accounts are permitted.)

- Enter the necessary amount, then click “Next.”

- Double check all information, then click “Submit.”

Steps for the recipient

- Once ready for pickup, you will be notified via SMS and email. A transaction number will be given to you.

- Visit your nearest Palawan Express remittance centre.

- Inform the teller that you are claiming cash via Metrobank and fill up the necessary form.

- Present your transaction number and valid ID.

- Claim your cash.

For more information, visit Metrobank’s official website.

3. UnionBank to Palawan Express

Service fee: 3% of total amount

Minimum amount: ₱100

Limit: ₱50,000 per transaction

How soon are funds available for pickup? About two hours; cut-off time for processing is 3pm.

How to send money to Palawan Express through UnionBank

- Go to the unionBank website or launch the mobile app and log into your account.

- Click “Send/Request.”

- Click “Remittance Center,” then choose Palawan Express.

- Enter your desired amount and purpose of transaction.

- Select your desired source account, then click “Next.”

- Enter the following recipient information:

- Full name

- Birth date

- Citizenship

- Mobile number

- Email address

- Review transfer details and accept the terms and conditions. Click “Send.”

- Enter the OTP sent to your registered mobile number.

- Save the reference number provided to you.

- Inform the recipient that the money will be ready for pickup once he/she receives the tracking code from an unknown Globe number via SMS. The tracking code will serve as the transaction money when claiming.

Steps for the recipient

- When the funds are ready for pickup, you will receive a tracking code from a Globe number.

- Visit your nearest Palawan Express branch.

- Inform the teller that you are claiming cash via UnionBank and fill up the necessary form.

- Present your tracking code and valid ID.

- Claim your cash.

For more information, visit UnionBank’s official website.

4. BDO to Palawan Express

Service fee: ₱100

Minimum amount: ₱100

Limit: ₱50,000 per transaction

How soon are funds available for pickup? Funds will be available within two to four working days.

How to send funds to Palawan Express through BDO

- Launch the BDO Mobile Banking app and log in to your account.

- Click “Send Money.”

- Select “For Cash Pick Up at any BDO Branch/Partner.”

- Click “Proceed without Template,” then “Pick Up Cash Anywhere.”

- Fill in the necessary details:

- Desired amount

- Your full name and address

- Receiver’s name, address, birthdate, gender

- Confirm that the details are correct, then click “Continue.”

- Tap “Send Money” then click “View Transaction Status.”

- Select “Cash for Pick Up.” On the next page, you’ll find a reference number. Send it to the recipient.

Steps for the recipient

- The sender should share a reference number with you.

- Visit your nearest Palawan Express branch.

- Inform the teller that you are claiming cash via BDO and fill up the necessary form.

- Present your tracking code and valid IDs.

- Claim your cash.

For more information, visit BDO’s official website.

Also read: How to Withdraw Money at BDO ATMs in Metro Manila Using Only a QR Code

5. Coins.ph to Palawan Express

Service fee: 3% of total amount

Minimum amount: ₱100

Limit: ₱50,000 per transaction

How soon are funds available for pickup? By 6pm or earlier, so long as the order is made before 3pm on a banking day.

How to send money to Palawan Express through Coins.ph

- Log into your Coins.ph account via web or mobile app.

- Make sure your account is ID and Selfie (Level 2) verified.

- Click “Cash Out” and select Palawan Pawnshop under “Remittance Centers.”

- Enter amount and recipient’s details:

- Name

- Phone number

- Full address

- Slide to send. The tracking number will then be sent to the recipient via SMS as soon as the cash is ready for pickup.

Steps for the recipient

- A tracking number will be sent to you via SMS as soon as the amount is ready for claiming.

- Visit your nearest Palawan Express branch.

- Inform the teller that you are claiming cash via Coins.ph and fill up the necessary form.

- Present your tracking number and two valid IDs.

- Claim your cash.

For more information, visit Coins.ph’s official website.

6. Palawan Express Online Padala

Service fee: 3% of total amount

Minimum amount: ₱1,000

Limit: ₱5,000 per transaction

How soon are funds available for pickup? Within one to four hours. Cut-off time for processing is 4pm.

How to use Palawan Express Online Padala

- Log on to the Palawan Express Online Padala website.

- Fill out the sender details.

- Provide the necessary transaction details:

- Recipient’s full name and mobile number

- Recipient’s relationship with the receiver

- Purpose of transaction

- Payment option

- To pay, take your pick from BPI, BDO, Coins.ph, or InstaPay.

- Enter your desired amount, then click “Continue.”

- Review your transaction details and the terms and conditions. Tick the box, then click “Continue.”

- Do not leave the Palawan Express transaction page. Follow the instructions for payment.

- Enter the provided reference number in the necessary field, then click “Mark as Paid.”

- Provide the four-digit OTP sent to your registered number, then click “Submit.”

- You and the recipient will receive an SMS with the transaction code.

Steps for the recipient

- Make sure to save the transaction code sent to you.

- Proceed to the nearest Palawan Express branch.

- Inform the teller that you are claiming cash via Palawan Express Online Padala and fill up the necessary form.

- Present your transaction code and valid ID.

- Claim your cash.

For more information, visit Palawan Express Pera Padala’s official website.

Also read: LIST: Bank Transfer Fees + Online Banks With NO Bank Charges!

We hope this guide on how to send money to Palawan Express from home will be able save you a trip to the remittance centre!

Published at

About Author

Gabriella Salud

Subscribe our Newsletter

Get our weekly tips and travel news!

Recommended Articles

14 Best Credit Cards for Travel in the Philippines 21AM Digital Museum by CCP Launches on 25 Feb 2022 View the inaugural exhibition for free!

Why You Have to Try Listening to 8D Music on YouTube It’s a mind-blowing experience.

12 #Adulting Apps Every Pinoy Millennial Should Have Confession: As I continue to progress further into my 20s, I undeniably find myself morphing into the tita I never thought I would be. And by this, I mean I’ve learned to (obsessively) monitor my expenses through various #adulting apps, realised we really do have food at home (because eating out has made a giant […]

10 Aesthetic Electric Fans That Scream #HomeGoals We scoured the Internet for the prettiest ones.

Latest Articles

Dingalan Travel Guide: Nature Spots to Discover Now Underrated coastal gem in Aurora

What to Eat in Bicol: Iconic Dishes and Treats, and Unique Pasalubong You’ll Love Spice up your foodie adventure with iconic Bicol dishes and must-try pasalubong!

Top Travel Trends in the Philippines for 2025 New spots, tips, and trends

New UK Adventure Park to Visit in Devon and Cornwall Fun countryside escape near London

Ultimate Camarines Norte Travel Guide: Waterfalls, Beaches, and More From surfing to secret waterfalls, Camarines Norte is your next escape!